Cryptocurrency meaning goes beyond digital coins—it has emerged as one of the most revolutionary financial innovations of the 21st century.. At its core, cryptocurrency is a type of digital or virtual currency that uses cryptography to secure transactions, control the creation of new units, and verify the transfer of assets. Unlike traditional money, also known as fiat currency, which is issued and regulated by governments and central banks, cryptocurrencies operate on decentralized networks powered by blockchain technology. This unique structure challenges long-standing notions of how money works, offering both opportunities and risks in equal measure.

The Birth of Cryptocurrency

The concept of digital money is not entirely new. Efforts to create electronic cash systems have existed since the 1980s and 1990s, but these early attempts often failed due to security flaws or reliance on centralized intermediaries. The breakthrough came in 2009 when an individual or group using the pseudonym Satoshi Nakamoto introduced Bitcoin, the first successful cryptocurrency. Bitcoin’s underlying innovation was the blockchain—a decentralized ledger maintained by a distributed network of computers (often referred to as nodes). This ledger records every transaction in a way that is transparent, secure, and immutable.

Bitcoin introduced the idea of a peer-to-peer financial system. Unlike traditional payment methods that require banks or credit card companies to act as intermediaries, Bitcoin allows two parties to transact directly with one another. This eliminates the need for trusted third parties and reduces costs, delays, and the potential for censorship or manipulation.

How Cryptocurrencies Work

At a technical level, cryptocurrencies use cryptographic algorithms to ensure the security and integrity of transactions. When a person initiates a transaction, it is broadcast to the network and grouped with others into a block. This block is then validated through a consensus mechanism such as proof-of-work (used by Bitcoin) or proof-of-stake (used by newer cryptocurrencies like Ethereum after its 2022 upgrade). Once validated, the block is added to the chain of previous blocks, forming the blockchain.

This decentralized system ensures that no single entity has control over the entire network. Every participant has access to the same transaction history, making fraud nearly impossible. Moreover, because the system is not tied to any government or central bank, it is resistant to inflationary practices such as printing money.

Beyond Bitcoin: The Rise of Altcoins

While Bitcoin remains the most well-known cryptocurrency, its success has paved the way for thousands of alternatives, collectively called altcoins. Some of the most notable include Ethereum, Litecoin, Ripple (XRP), and Cardano. Each of these cryptocurrencies builds upon Bitcoin’s foundation but often introduces unique features.

For example, Ethereum allows developers to create decentralized applications (dApps) and smart contracts, which execute automatically when certain conditions are met. This capability extends the use of blockchain beyond money into areas such as supply chain management, healthcare, and voting systems. Similarly, other cryptocurrencies focus on enhancing transaction speed, privacy, or scalability.

Advantages of Cryptocurrencies

Cryptocurrencies offer several benefits that make them attractive to users worldwide:

- Decentralization – No central authority controls the currency, reducing risks of manipulation.

- Lower Transaction Costs – Cross-border payments can be completed quickly and often with lower fees than traditional banks.

- Financial Inclusion – People without access to banking systems can participate in the digital economy with only a smartphone.

- Transparency and Security – Blockchain ensures all transactions are publicly verifiable and nearly impossible to alter.

- Ownership and Control – Users have full control over their digital assets without relying on intermediaries.

Challenges and Criticisms

Despite its promise, cryptocurrency faces significant hurdles. Volatility is one of the most pressing issues, as prices can fluctuate dramatically within hours. This instability makes cryptocurrencies less practical as a stable medium of exchange.

Another concern is regulation. Governments around the world struggle to classify and regulate cryptocurrencies, balancing the need for innovation with concerns about money laundering, tax evasion, and financing of illicit activities. Additionally, environmental critics point to the high energy consumption of proof-of-work mining, though newer systems like proof-of-stake aim to address this issue.

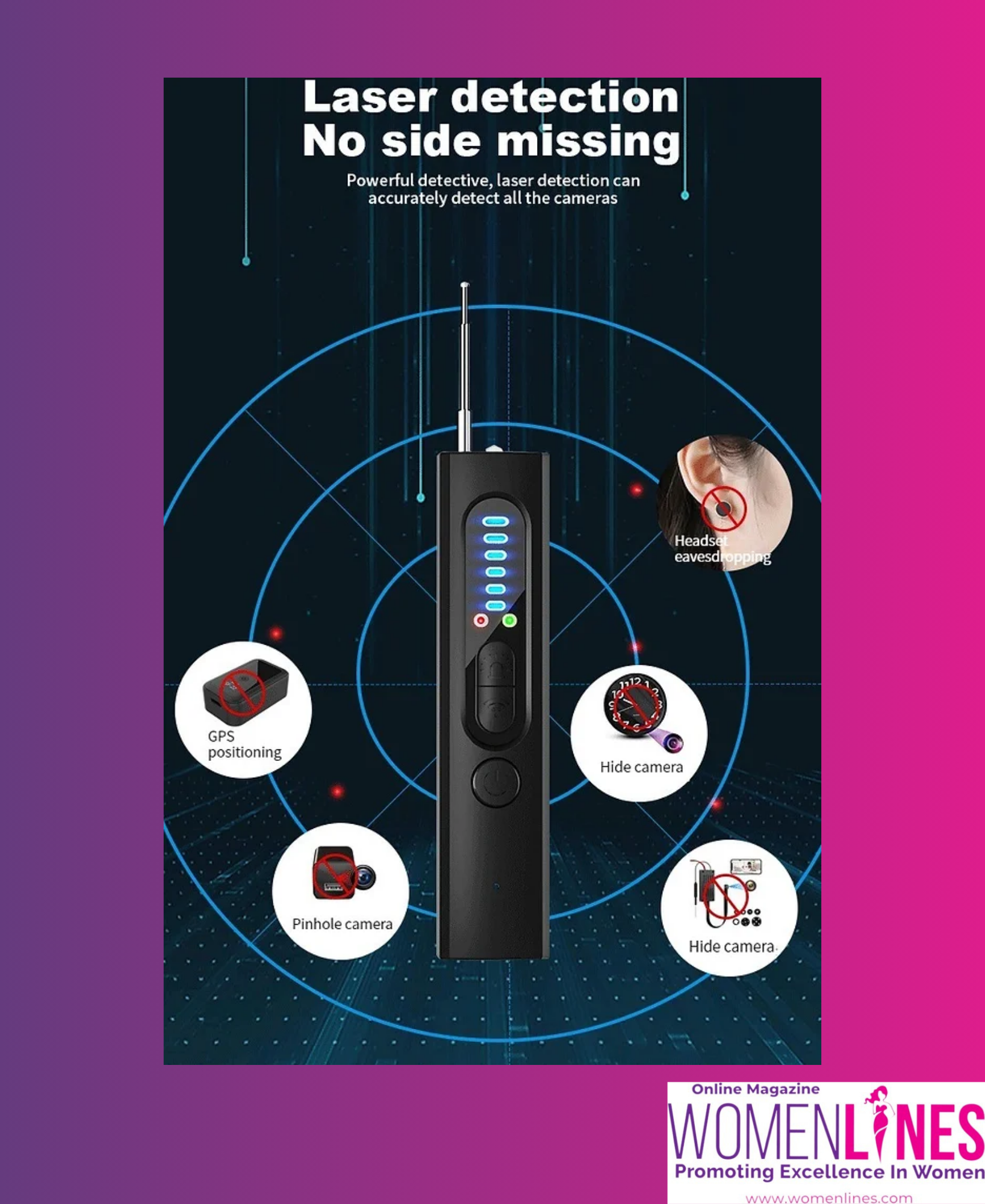

Security also remains a challenge. While the blockchain itself is secure, cryptocurrency exchanges and wallets have been frequent targets of hackers, resulting in millions of dollars lost. Users must be cautious and informed about how to safeguard their digital assets.

The Future of Cryptocurrency

The future of cryptocurrency is both promising and uncertain. On one hand, institutional investors, major corporations, and even governments are beginning to embrace digital currencies. Central banks are exploring the idea of Central Bank Digital Currencies (CBDCs), which would blend the advantages of blockchain with state control. On the other hand, regulatory crackdowns, technological hurdles, and market instability could slow down or reshape the industry’s trajectory.

Nevertheless, it is clear that cryptocurrencies have already left an indelible mark on the global financial system. They represent not just a new form of money, but also a new way of thinking about trust, ownership, and value in the digital age.

Cryptocurrency is far more than a speculative asset or a passing trend. Born out of a desire to create a decentralized financial system, it has evolved into a complex ecosystem with profound implications for commerce, technology, and society. Bitcoin’s introduction in 2009 opened the door to a future where money is no longer tied to governments or traditional banking institutions. While challenges remain, the transformative potential of cryptocurrencies ensures they will continue to shape the financial landscape for years to come.

Stay tuned for a series of educational crypto articles

I am Prema Chuttoo.

I am Prema Chuttoo.

SAP Technical Consultant/Company Director/author

Belgium

Also read: Achieve Work-Life Balance Using Monica.im’s Tools

Follow Womenlines on Social Media