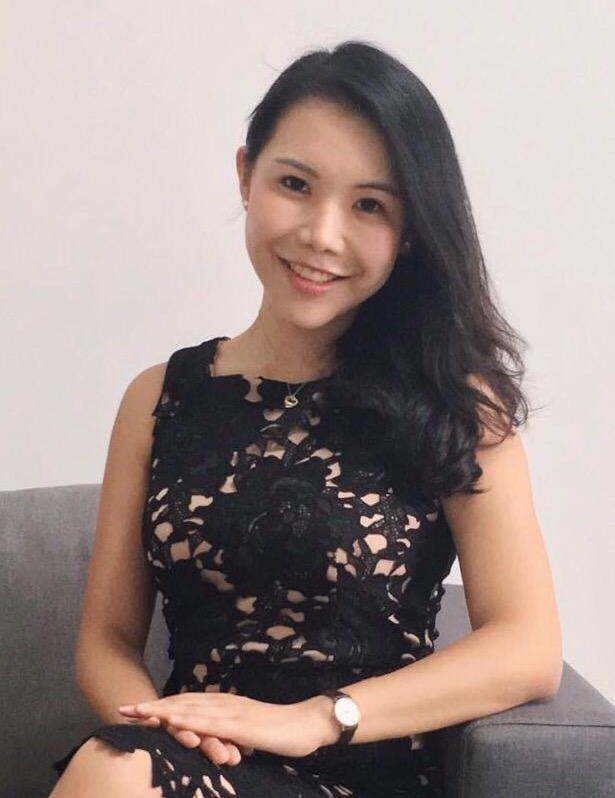

Val Yap is the founder of PolicyPal, Singapore-based InsurTech startup accelerated by Startupbootcamp FinTech. Policy Pal is helping people manage, track, and understand their insurance policies.

PolicyPal was started out of frustration with buying and managing insurance. The pain of dealing with messy paperwork and need to track renewal dates. PolicyPal’s free insurance portfolio review is the best (and only) digital big picture tool around. It is a one-stop shop for everybody to understand, manage and buy insurance. PolicyPal uses artificial intelligence to simplify and digitize insurance for you to manage all your existing policies from different insurers so that you always have quick access to your insurance policies even if the unexpected happens. Using the app, you can pay and renew your policies with a touch of a button.

Read about Val’s entrepreneurial journey in her own words-

1.Please share with our reader’s little bit about yourself?

I was previously an Assistant Vice President at OCBC Bank. Primarily focused on launching the digital initiatives and campaigns, working closely with the wealth, digital and marketing to drive innovations.

Previously served as Risk Assurance Associate at PwC London office, worked with UK Financial Institutions to develop implementation plans for the changes required for USA Foreign Account Tax Compliance Act (FATCA) compliance and regulatory assessment for UK Financial Institutions.

I started PolicyPal in April 2016, have since joined Startupbootcamp Fintech and Income Future Starter.

2. So when did you venture into this venture and what inspired or motivated you to take a plunge into this venture?

Several years ago, my mom was diagnosed with cancer and had her insurance claim unexpectedly rejected because of several lapses my family was unaware of. Despite the medical crisis, my siblings and I had to scour through stacks of insurance documentation to check and understand the extent of my Mum’s coverage. This painful experience made me realized the importance of having a well-organized folder of my insurance policies and documents.

I thought, if this could happen to me, it could happen to anyone. Why not create a digital folder for my friends to consolidate their insurance policies? Without a doubt, it was hard for me to give up a career on the leadership management track in the banking sector. However, I soon realized that my conviction to help make a difference to the lives around me was simply over empowering.

3. Can you share with us some of the challenges you faced during your initial days?

The startup is difficult. Focus, do one business at a time and commit to it until it blooms and blossoms. As the insurance space is huge, we had many people telling us to try different managing different areas and move to banking accounts, investments, etc. Figuring out how to juggle near-term priorities with mid to long-term priorities. There is no “one” thing – it could be funding, product development, partnerships, recruiting, etc.

Talent or lack thereof is a huge problem. We need super smart, highly motivated team to create a great startup. Unfortunately, these are hard to come by unless you are willing to pay top market rate. There are not enough resources yet so many opportunities., we need to have laser focus and know when to say no. There are so many opportunities that it can quickly distract the progress if we try to address them all.

I also learned that we must be ready to fail as it’s another form of learning. It’s a journey, not a destination, so you better enjoy the trip!

4. So how do you balance your personal and professional life?

It takes being mindful of priorities. You do the business to make your life better, not give your life to make the business better. The kids will only be little for a very small time, and if you miss that, you can’t make it up. Relationships matter to most of us. It’s easier to build a business or find a new job than to find a new spouse.

One insight required is that at a startup there is always more to do. Work could be 24 hours a day, 7 days a week, and there will still be more to do. So you stay aware of what’s most important.

5. What would you suggest to other aspiring women who want to venture out on their own?

Find a female Mentor: Being a woman, and finding and working with female mentors have been a game changer. There are many experiences you will have as an aspiring entrepreneur that men don’t undergo, and it’s important to find and build friendships, mentorships, with the same gender who can understand 100% what you’re going through. Find female groups and initiatives that provide support to each other.

Don’t spread yourself too thin. Find out what you believe in, and learn what you don’t know. It will be somewhere awesome because of the hard work you put into your journey. Don’t just start a tech startup to start a tech startup. It’s too difficult. Rather, go deep on a mission, market that captures your curiosity, and that you can imagine working on for the next 10 years. Be extraordinarily good at it that people come to you for your expertise.

Work smarter, not harder. Your career as an entrepreneur is not about, “Just keep going.” It’s about, ”What can I do to deliver and build the thing I am passionate about bringing into this world?” You can find shortcuts that allow you to serve your market and show amazing results.

6. Is there any person who has mentored/supported/inspired you?

J.K. Rowling had just gotten a divorce, was on government aid, and could barely afford to feed her baby in 1994, just three years before the first Harry Potter book, Harry Potter and The Philosopher’s Stone, was published. While Rowling was writing the first book she lost her mother Anne and so she introduced more about Harry’s loss in the first book. When she was shopping it out, she was so poor she couldn’t afford a computer or even the cost of photocopying the 90,000-word novel, so she manually typed out each version to send to publishers. It was rejected dozens of times until finally Bloomsbury, a small London publisher, gave it a second chance after the CEO’s eight-year-old daughter fell in love with it.

7. What do you have in the pipeline for your venture’s future development?

PolicyPal is looking to collaborate with insurers to help them bridge their gap with the consumers. We will soon be launching a feature where you can start sharing your insurance policies with your family members so that they can have access to them during an emergency.

Linkedin: https://www.linkedin.com/in/

Web app: http://policypal.co/

Womenlines wishes best of luck to Val for a successful journey with PolicyPal!

Charu Mehrotra

Promoting excellence in women!

Subscribe to Womenlines, the top-ranked online magazine for business, health, and leadership insights. Unleash your true potential with captivating content, and witness our expert content marketing services skyrocket your brand’s online visibility worldwide. Join us on this transformative journey to becoming your best self!

Subscribe to Womenlines, the top-ranked online magazine for business, health, and leadership insights. Unleash your true potential with captivating content, and witness our expert content marketing services skyrocket your brand’s online visibility worldwide. Join us on this transformative journey to becoming your best self!